The bezzle

Note: This post has originally been published in the CFA Institute Enterprising Investor Blog on 12 September.

In his book The Great Crash of 1929, John Kenneth Galbraith writes about the bezzle, the total number of embezzlements that grow in a time of rising markets. He notes that when markets collapse, these schemes all blow up and cause large losses to investors. However, as Galbraith writes, there is a sweet spot when the bezzle has been committed but not yet discovered. Or in his own words:

Weeks, months, or years may elapse between the commission of the crime and its discovery. (This is a period, incidentally, when the embezzler has his gain and the man who has been embezzled, oddly enough, feels no loss. There is a net increase in psychic wealth.)

I think the bezzle of the current bull market aren’t Ponzi schemes and frauds but the notion that risky assets have become practically riskless thanks to central bank policies.

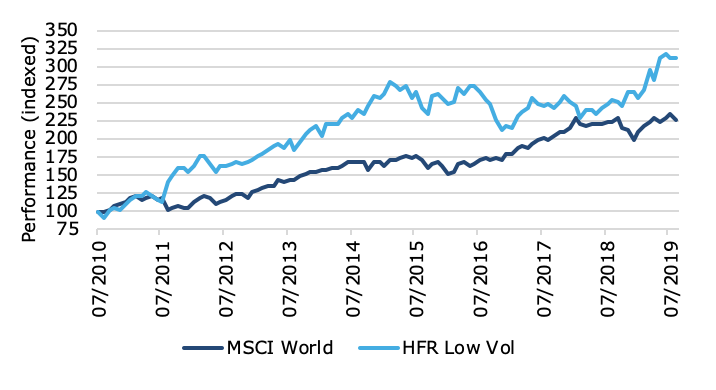

Ever since central banks have cut interest rates close to zero, investors have been told to stretch for yield and take on more risk in their portfolios. First, there was TINA (There Is No Alternative to stocks) then came the hunt for yield in bonds and the use of low volatility and high dividend stocks as a substitute for bonds. No wonder low volatility stocks have outperformed the global equity market over the last decade.

Performance of MSCI World vs. HFR Low Vol Risk Premium Index

Source: Bloomberg, HFR.

I even heard investment strategists quote Mark Zuckerberg:

The biggest risk is not taking any risk.

One of the stupidest things anyone ever said. The thing with risk is that taking risk is necessary, but taking risks means one can fail if the risk materializes. Thus, there are always risks that are not worth taking because they will eventually lead to catastrophe. That Mark Zuckerberg can get away with saying something this stupid is simply a reflection of survivorship bias. There have been plenty of entrepreneurs who took risks and failed. We just don’t hear from them afterwards.

Over the last decade, investors have felt like they were forced to take on risks. I remember a family office client of mine who asked me to optimise their portfolio. For historical reasons, their portfolio was one third invested in property, one third in a single stock (the company of the founder) and one third in liquid assets. Because the family office was based in Switzerland, it faced negative government bond yields for most government bonds. So, what do you do?

We couldn’t add property or stock market investments to the portfolio because of the highly concentrated positions they already had. In fact, the family office was forced to decide between taking on duration risk, credit risk or foreign exchange risk in fixed income investments or a combination of these factors. It wasn’t a nice situation, but in the end, the family office opted for a combination of credit and duration risk. This has worked out well so far but just because risks don’t materialise, it does not mean that they are not there.

It seems to me that the last couple of years we have been in this blissful state of increased psychic wealth as Galbraith would say. But if we face a recession, some of these risks will come back to bite investors and the bezzle will shrink. Central banks have provided ample liquidity since the financial crisis and as someone said:

Giving liquidity to a banker is like giving a barrel of beer to a drunk. You know exactly what is going to happen, but you don’t know which wall he is going to choose.

And I think once we come closer to a recession in the US and in Europe, we are going to find out which wall we are going to hit. I have no idea which one it is going to be, but my guess is that credit risks and equity market risks will both come back to haunt us. But my guess is as good as anyone’s.

What we as investors have to do today is take a look at the risks that are buried in our portfolios. As I have said recently, we had a very calm first half of 2019 and this is usually the best time to prepare for a bumpy ride ahead. Now, it seems these volatile times are coming and if you haven’t done it, yet, check your portfolio and make sure you only take risks that you can live with.

If you don’t feel comfortable with some risks in your portfolio reduce them or hedge them. And this is where government bonds – even at negative yields – can be really helpful. Because they do provide a level of safety that is hard to come by in other asset classes.

If you feel that it makes no sense to hold low yielding government bonds, cash or other safe assets in your portfolio at these yields, then I suggest you read tomorrow’s post on the fourth rule for the Virtuous Investor. In it, I will show you a technique, how you can look at your portfolio in a different way so that you understand why you hold safe assets and what role they play in your portfolio. Hopefully, this will enable you to better manage your risks and achieve your financial goals. Stay tuned…