We, unfortunately, live in a time where wars and their cost to society have become a more urgent and salient topic again. And while we all wish no new wars would start, it is clear that there are a couple of hot spots in the world where the outbreak of war is possible, if not probable. And now there is a website where you can get an idea of the economic damage such wars would cause.

In my book on geopolitics for investors, I emphasise that the economic cost of wars depends heavily on where the war is fought. If a war is fought on your home soil, infrastructure and other forms of capital get destroyed, causing an enormous loss of economic output. Furthermore, inflation tends to increase rapidly because governments need to issue a lot of debt to finance the war. Meanwhile, if the war is a foreign war, like all the wars the United States or the UK have participated in since the end of World War II, the cost to the economy is small and the impact on inflation is virtually non-existent. In fact, in some circumstances, the economy can get a small boost to GDP from higher defence spending.

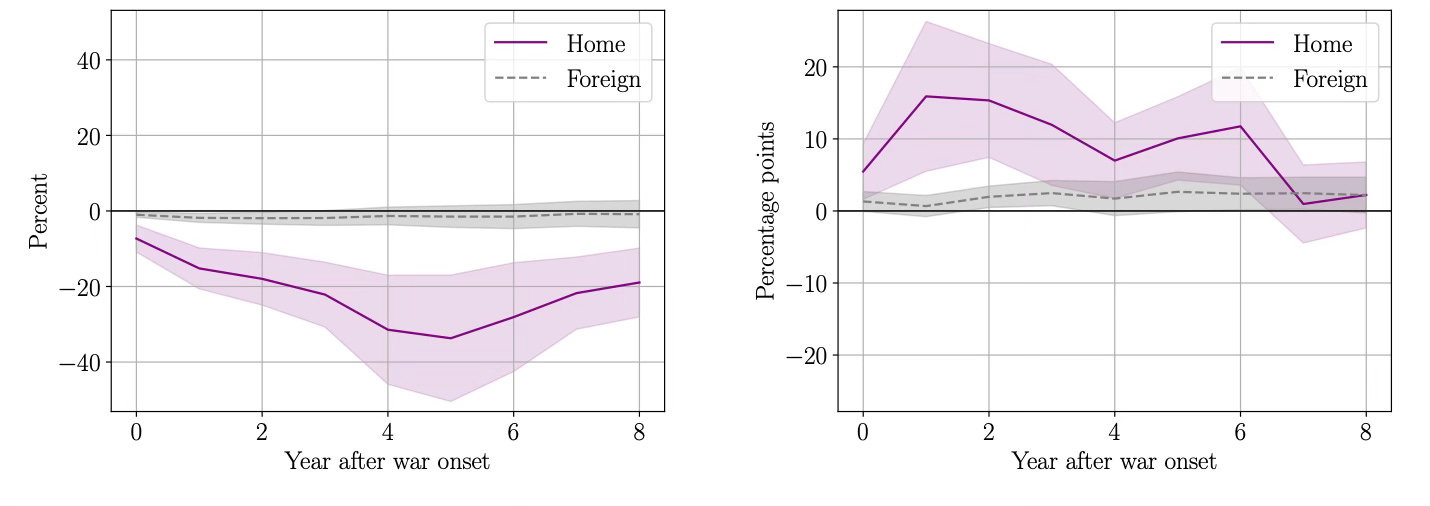

These basic results have once again been confirmed in a new study by Jonathan Federle and his colleagues from the Kiel Institute for the World Economy. They collected data from more than 60 countries and the impact of wars they have been in between 1870 and 2022. Below is the key chart that shows the impact on GDP and inflation of wars fought at home vs. foreign wars.

The impact of domestic and foreign wars on output (left) and prices (right)

Source: Federle et al. (2024)

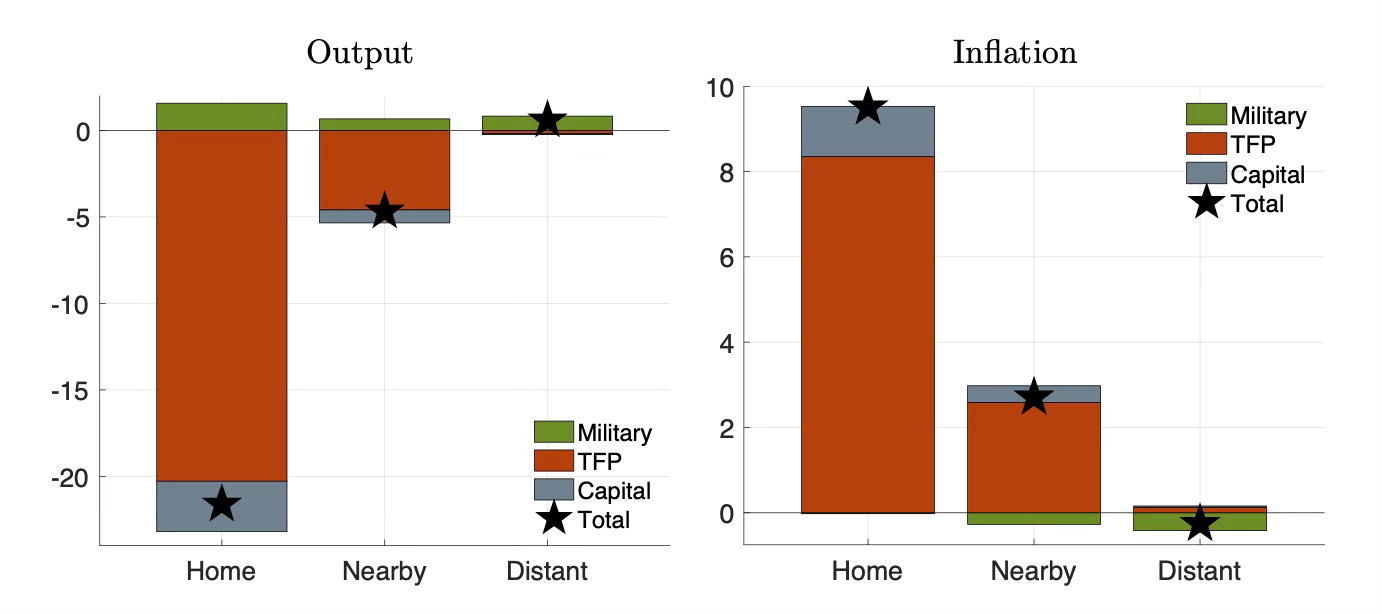

With the help of a model built to fit the data, they can also show that most of the loss in output and increase in prices comes from the rapid deterioration in total factor productivity. As men are called to serve on the frontline and infrastructure is either destroyed or used for military purposes, productivity in the economy drops by a large amount accounting for most of the loss in output and increase in inflation.

Drivers of the loss in output (left) and increase in prices (right) of wars

Source: Federle et al. (2024)

And here comes the best part about this model. The authors have made it available for free on a website. Anyone can go and ‘simulate’ a war in a country and its economic impact on other economies.

Earlier this year, there was a discussion about the possibility of North Korea attacking its southern neighbour this year. With the help of the Price of War website, we can at least get some estimates for the global economic cost of such a war.

Unfortunately, it doesn’t say anything about the human cost, which is much more important and much larger, but alas, this is an economics post and an economic analysis, not a humanitarian one.

In terms of GDP impact, their model estimates that a war on the Korean peninsula would reduce South Korea’s GDP by 31% after four years, Japan’s by 2.8% and China’s by 2.7%. The UK and most European countries would see an estimated 1% drop in GDP over four years, while in the US, the impact on GDP would be some 0.75%.

As for the inflation impact, South Korea would see its prices rise by some 16% while Japan and China would face an inflationary push of 2.5% or so after three years. In Europe and the US, the impact on prices would be some 0.5-1% after three years.

Overall, a war on the Korean peninsula would have a severe impact on Korea, and quite a substantial impact on China, Japan, Europe, and the US. If these economies are in a low growth phase before the outbreak of the war or close to recession, a war on the Korean peninsula could push these countries into recession.

Great topic. Looking forward to reading your book. Thank you.

"The Watson Institute for International & public affairs at Brown University initiated a Costs of War project in 2010 ... that analyzed the full costs of the total War on Terror. The costs continue to pile up even now that the war is over. As of fiscal year 2022, they estimate the total cost of the war so far to be approximately $5.8 trillion. This includes ...direct war funding ...military expansion ... creation of the Department of Homeland Security ... cumulative veteran's benefits, and $1.1 trillion in interest on the debt used to pay for it." (p 164)

BROKEN MONEY

by Lyn Alden

I am reading this book now.

Is the war in Ukraine domestic or foreign for Russia?