The evidence is mounting...

I have become passionate about my arguments that monetary policy has become completely ineffective. Yet, central bankers and many investors still act as if monetary policy could save the economy in case it falls off a cliff. The experience of the 2020 crisis should demonstrate that this is not the case anymore. Rate cuts and QE did little to help the economy or stock markets for that matter. What helped was the fiscal stimulus in the form of emergency loans and furlough schemes.

But every change in science and knowledge takes time and usually only happens when the evidence has become incontrovertible. And when it comes to monetary policy at zero or negative rates, the evidence keeps piling up. A group of Israeli economists has tried to measure investors’ willingness to borrow money or increase investment risk in a negative rate environment. To avoid any contamination from other effects they did what has become standard practice these days: a lab experiment.

205 business students were invited to join an experiment where they got to invest 10,000 NIS (c. £2,362 or $2,915) and could borrow an additional 10,000 NIS if they wanted. The participants were randomly divided into different groups that were given a different starting central bank rate. After the participants made their decision, how much money to borrow, they could invest in either a risk-free bank deposit, a corporate bond with medium risk, and stocks. After this first round, they were told that the central bank had lowered interest rates by 1 percentage point, and they got to make the same decisions all over again.

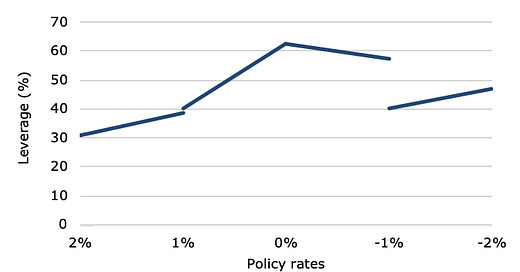

Our first chart shows the decisions of the different groups to borrow money. Because the participants were randomly divided into four different groups with different starting interest rates, the results don’t line up neatly, but the overall trend is clearly visible. In a world of positive interest rates, lower rates increase the demand for loans. In a world of zero and negative interest rates, they don’t.

Chosen leverage as monetary policy rates decline

Source: David-Pur et al. (2020).

That money then has to be invested, and as one would expect, in a positive interest rate environment, reducing the interest rate leads to a lower allocation to the risk-free asset and a higher allocation to stocks and bonds. However, once we reach negative interest rates, lower interest rates don’t do anything anymore to entice additional risk-taking. Quite the opposite. The allocation to the risk-free asset increases slightly while the allocation to bonds declines. In other words, investors start hoarding cash.

Chosen allocation to the risk-free and risky assets

Source: David-Pur et al. (2020).

Empirically, this is what we observe in Japan for decades now. Despite zero interest rates, Japanese households and businesses have an extremely high cash quota in their savings and have been reluctant to take out loans. Could it be that we are heading down the same road?