The first really awesome biodiversity resource

Last year, I asked my readers to let me know if they have any good data on the relevance of biodiversity risks for investments. While I got lots of input from my readers, this input was usually company-specific and didn’t allow for a systematic analysis of biodiversity risks across companies. Furthermore, nobody could point me in the direction of studies that show that biodiversity risks are priced in markets. As I said back then, we are currently at the beginning of the journey. Now, it seems, we have taken a major step forward.

Stefano Giglio and his colleagues at NYU Stern have published a truly great paper that tries to quantify biodiversity risks for companies in different ways. One way they tried to quantify risks is by counting media articles that mention biodiversity issues. As the chart below shows, by now there is an article published almost every day now that discusses biodiversity issues.

Media mention of biodiversity issues

Source: Giglio et al. (2023)

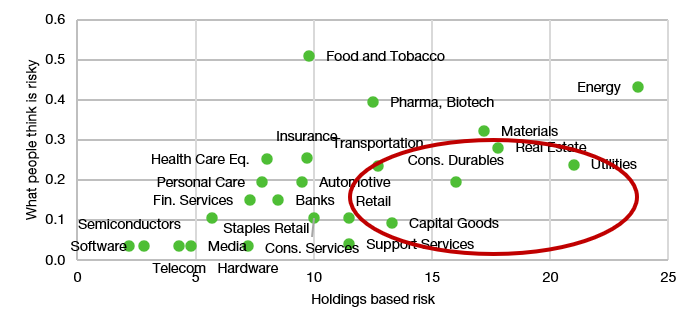

They also survey practitioners and academics on their views of biodiversity risks and which industries are most at risk from the decline in biodiversity. Finally, and this is where things get really cool, they scan 10-K and other company reports for discussions of biodiversity, either as opportunities, risks or regulatory issues. This allows the authors to compare the risk from loss of diversity as perceived by investors and academics vs. the risk as discussed in company filings. Take a look at the chart below that plots these two dimensions against each other.

Perceived risks of sectors and holdings-based analysis of biodiversity risks

Source: Giglio et al. (2023)

There are clear mismatches in the perception vs. discussion of biodiversity risk. For example, surveys indicate that the food, beverage and tobacco industries have the greatest biodiversity risk (I would have said the same). But a fundamental analysis of risks discussed in company filings indicates that this sector isn’t all that exposed to biodiversity risks. Instead, retail companies, real estate and utility companies face higher risks from increased scrutiny and regulation of biodiversity. This seems to be a blind spot for investors right now.

Furthermore, the data these researchers collect allows them to check if share prices show any correlation with biodiversity risks. And here the evidence is still pretty weak. The correlation between share prices and the media reports on biodiversity risks is still only about 0.1. Hence, biodiversity risks are hardly priced in equity markets, if at all. But correlations may increase over time. After all, a decade ago, we hardly had any evidence that climate change risks were priced in equity markets. Today, the evidence is pretty strong that they are.

And thanks to the research of Stefano Giglio and his colleagues we can now track progress in biodiversity risk exposure. And you know what the best thing is about all that? The researchers have made their data available for free online. Their website biodiversityrisk.org is a must-have bookmark for every ESG investor. Check it out, it is truly awesome.