The “I love me”-effect

There is one overlooked difference between professional investors like fund managers and individual investors: Individual investors don’t have to look at their portfolios every day.

If you look at your portfolio too often the temptation grows to sell your winners and stick to your losers. Exactly the opposite of what you should do from a performance perspective.

There is at least anecdotal evidence that individual investors have increased their investments and levered up their portfolios since the recovery in April. But how long are they going to hold on to these stocks? Are they going to sell in time before another correction? Or are they going to sell too soon or too late? I have touched on the psychological challenges of buying into a recovery here.

But one effect, that I might have underestimated is what academics call “attention utility” and I call the “I love me”-effect. It is the all too human tendency to enjoy admiration and success for its own sake.

When it comes to investing, we all like a winner, particularly, if we have picked it. So, when we buy stocks or other risky investments and we make a profit, we like to remind ourselves of how smart, successful, beautiful, etc. we are. And in the days of online brokerage that is pretty simple: just log in to your brokerage account and enjoy your success.

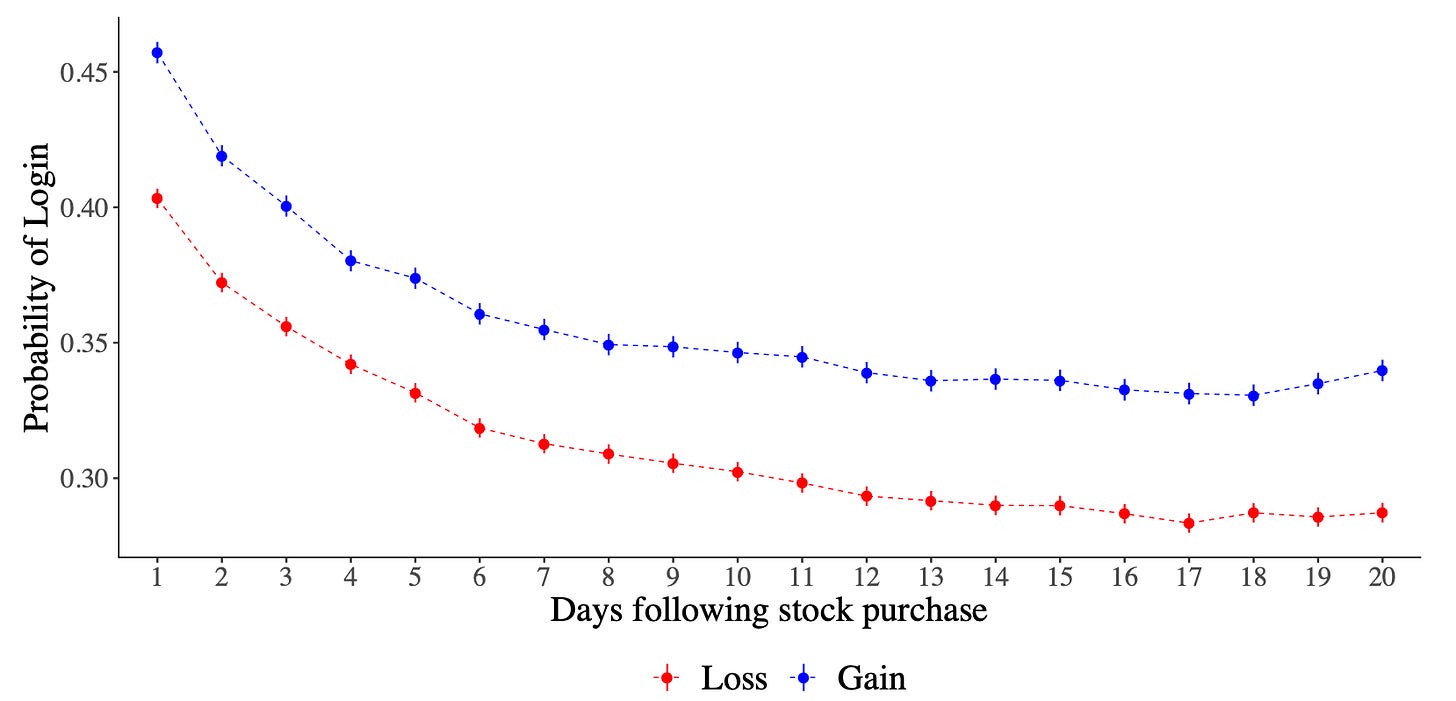

A study on brokerage account logins has shown that people are much more likely to take a look at their portfolios after they have made a profitable investment than when they have made a losing one. They may not sell their investment; they just want to look at it and enjoy their success. Of course, the problem is that the more often we look at our portfolio, the more we notice short-term fluctuations and even the best stocks will eventually have a small setback that lasts a couple of days. But every time they log in to their accounts, they update their price anchor to the latest top. And if the stock starts to decline from that top, investors start to fear for their losses (and their bragging rights) and get tempted to sell.

Which brings me back to the advice I give again and again:

Don’t look at your portfolio too often.

Probability of login to a brokerage account depending on performance since purchase

Source: Quispe-Torreblanca et al. (2020).