This post is part of a series on The Virtuous Investor. For an overview of the series and links to the other parts, click here.

“Two dangers chiefly follow good men, one lest in temptation they give up their hold. Another lest after the victory in their consolation and spiritual joy they wax wanton and stand in their own conceit, or else please themselves.”

Erasmus of Rotterdam

In 1968, Fortune Magazine wrote about General Public Utility Corp.’s plans to replace its cash dividend with stock dividends. The company also offered to sell the stocks investors earned as dividend for a minimal fee so that investors could convert them into the old cash dividend if they so wished. At the time, implementing the stock dividend would have save the shareholders $4 million in taxes per year and the company would have saved an estimated $20 million per year. How did the share price react to this announcement? It dropped sharply and the President of the company was inundated by letters from private and institutional shareholders calling him a “hypocritical ass” and advising him to seek psychiatric care. Eventually, the company abandoned its plans to replace the cash dividend due to the massive pressure from investors.

How can it be that investors prefer cash dividends over stock dividends to such a degree that they would be willing to forego massive tax relief for themselves and the company? In a seminal study, Hersh Shefrin and Meir Statman recount this event and provide an explanation in the form of regret aversion.

Assume, you want to buy a new TV for $1,000. You can either use the $1,000 in dividends you received from a stock you own, or you can sell $1,000 worth of stocks and use the sales proceeds to buy the TV. How would you feel if the share price increased significantly in the weeks after you bought the TV?

Most people would feel significant regret if they sold the shares to buy the TV but not if they used the dividends to buy the TV. Theoretically it should not matter if you used dividends or shares to buy the TV because if you hadn’t bought the TV, you could have used the dividends to buy $1,000 worth of stock and participated in the rally. Yet, people don’t think that way. They try to prevent feelings of regret that are caused by their actions and this means, they tend to give in to feelings of both pride and despondency.

Regret aversion tends to be particularly strong when people are under emotional stress. So, imagine you have just witnessed a stock market correction, like the one we saw at the end of 2018. US stock markets are down more than 10% between October and Christmas while markets in Europe and Asia have declined even more. Now you can choose to invest additional money in the stock market to benefit from the fact that stocks are offered at a nice 10% discount. Will you do it? How would you feel if you bought the additional stocks and the market drops another 10%?

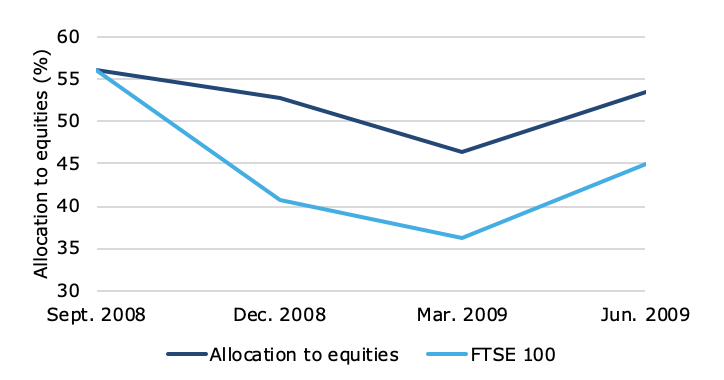

You guessed it. Most people would rather not invest in stocks at that point in time because they fear prices could go down even further. So, they give in to their worries and despondency and stay out of the market. This despondency of investors could be observed in real time by Martin Weber and his colleagues during the financial crisis. Starting in September 2008 they surveyed the clients of a UK brokerage firm every three months and asked them a series of questions. One of these questions was, how much they would invest in equities if they were given £100,000 to invest. As the chart below shows, the allocation to equities declined as the FTSE 100 declined and only increased, once the market started to recover.

Willingness to invest in stocks during the financial crisis

Source: Weber et al. (2012).

At the other end of the spectrum, investors can feel enormous pride of their investments if they happen to be successful. Unfortunately, this also means that investors tend to sell their investments once they have made a significant gain, because they fear the regret they would experience if they had not sold the stocks and then not only lost the gains but maybe even suffered a loss. By selling the winners, one can lock in that feeling of pride forever (and annoy one’s friends with the tales of great investments).

On the other hand, if investors are suffering a loss in their portfolio, they won’t sell that investment and cut their losses, because, well, “what if the share price recovers after I sold it?”

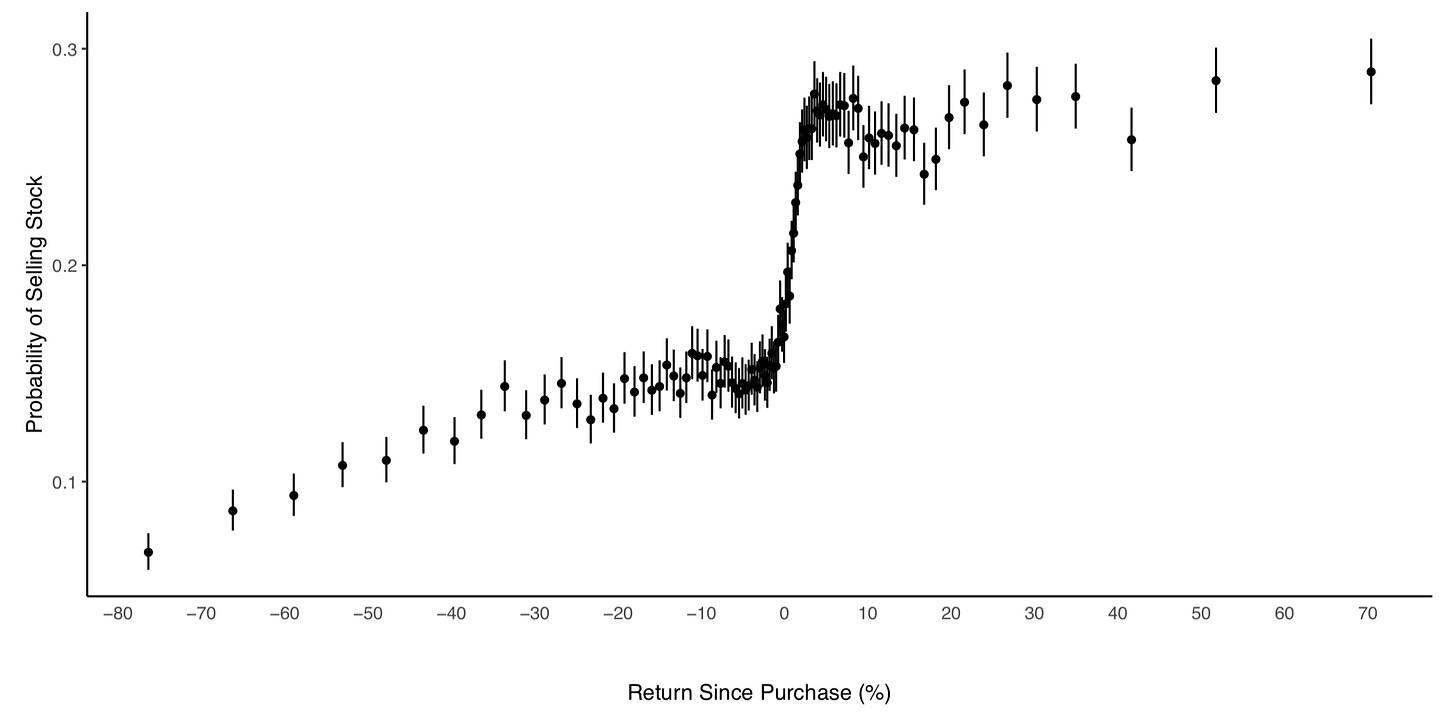

The first study that showed this propensity to sell winners and hold on to losers was done by Brad Barber and Terrence Odean in the late 1990s, but recently, John Gathergood and his colleagues have not only replicated this study with clients from a large online brokerage firm, but dug deeper into the evidence. The chart below shows the latest iteration of the original effect uncovered by Barber and Odean. It shows the probability that a stock is sold by an investor depending on the gains or losses incurred since the stock was purchased. Once investors are sitting on gains, they are suddenly prone to give in to their pride and sell the shares.

Probability of sale depending on the return since purchasing the stock

Source: Gathergood et al. (2019).

But the beauty of the recent study was that the researchers could also track what happened between each time the investors logged on to their brokerage account. And they found that every time investors logged into the system and looked at their portfolio, they re-calibrated their emotions. In effect, every time they logged into the system, they got a new anchor for the price of their investments. And if they saw a loss since the last time they logged on to the system, they were again less likely to sell the shares.

If, on the other hand, they saw a gain not only since buying the stock but also since the last time they logged on, then they were even more likely to sell the stock. After all, if they sold at that moment, they could experience double the pride. They were realising a profit not only since they bought the stock but also since the last time they looked at it.

Probability of sale depending on the return since purchasing the stock and return since last log on

Source: Gathergood et al. (2019).

What can the virtuous investor do then, to avoid giving in to pride and despondency? The answer is simple and effective.

Don’t look at your portfolio too often.

Every time you look at your investments you run the risk that you see a gain that will push you to take profits and sell the investment. Every time you look at the portfolio you might see a loss that causes anguish and reinforces your despondency. Long-term investors should check their portfolio only once per year while short-term investors should try to look at their investments as little as possible. Typically, once per quarter or once per month will be enough. As I have discussed in rule 8 of the virtuous investor, trading is bad for your performance and the more you look at your portfolio, the more you trade.