The Gamestop bubble at the beginning of this year has created an enormous amount of research by academics in recent months, much more than any other bubble in recent memory. By now we know that retail investors did not “win” against the big hedge funds. Just like I anticipated in January, there is no evidence that retail investors on average made money during the Gamestop episode or that the investment decisions of retail investors can be used to make money in stock markets.

The folks who participated in the Gamestop frenzy were essentially uneducated investors playing the lottery, were mad at Wall Street and overconfident in their ability to beat hedge funds at their own game.

In general, being stupid and overconfident is the best way to lose money. Heck, somebody once told me that the number one cause of death for young men between the age of 16 and 30 is stupidity. And yes, it’s mostly men, because young men think they have figured out the world and have way too much testosterone in their blood to think before they act – especially if they think they can express an attractive girl with their actions. Whether it is falling off a building while taking a selfie on the ledge of a skyscraper, fainting while holding your breath driving in a tunnel and then causing a car crash, or tying yourself to a shopping cart and then pushing the cart into a deep lake, young men are idiots. And if you are the parent of a teenage boy, you know I am right.

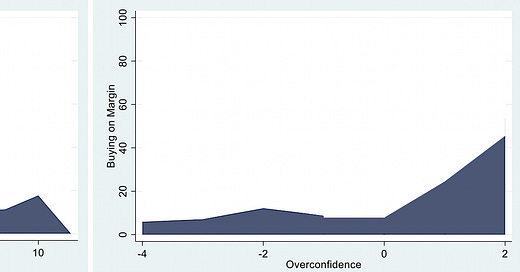

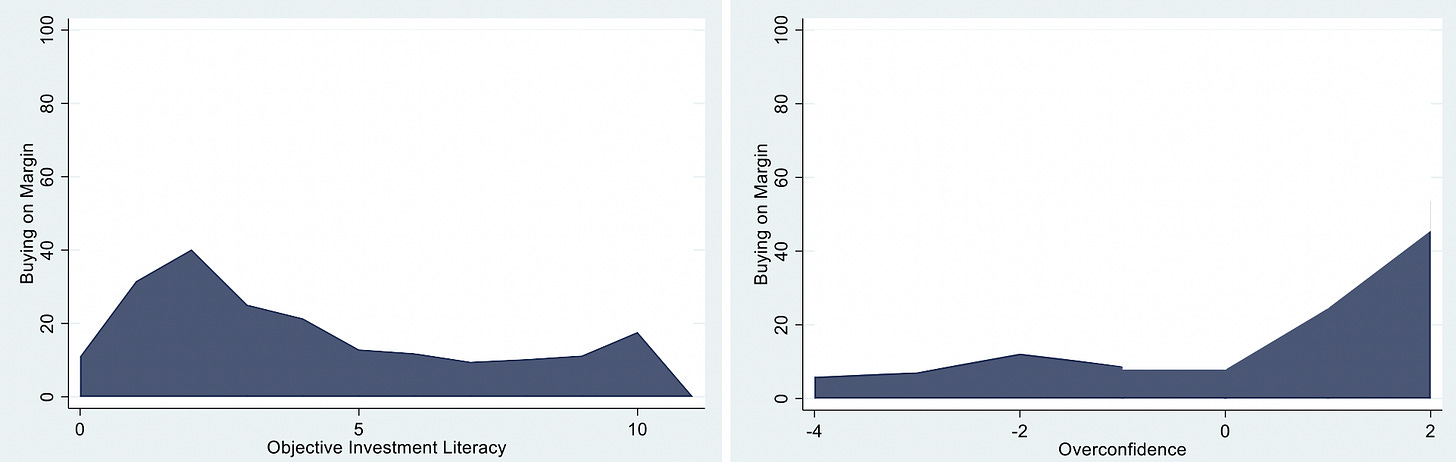

But going back to investing, stupidity paired with overconfidence can cause a lot of harm there as well. An analysis of retail investors tried to figure out who buys stocks on margin and who is likely to get a margin call. Turns out that two factors play the key role in determining which investors buy stocks on margin: financial literacy and overconfidence. The charts below show that investors with lower financial literacy are more likely to buy stocks on margin, presumably because they don’t fully understand the risks of buying stocks on margin. In the most extreme cases this can end tragically, as we have seen this year. The second driver is overconfidence. The more confident investors are in their ability to pick stocks, the more likely they are to use margin to boost their investments. Combine a lack of financial literacy with an abundance of overconfidence and you have: a young man making his first trades in the stock market and getting hammered. The best case outcome is that these losses from their investments are “school fees” to be paid as these young investors learn about how markets really work and that there simply is no easy way to get rich quick.

Financial literacy and overconfidence the key drivers of the use of margin

Source: Kim et al. (2011)

I like to call it the Dunning-Kruger effect/ It is not so bad if I am stupid. What is dangerous is when I have no clue how much....and yes, young men (even older ones) have issues with blood flow (when it goes to one part of the body, the brain is suddenly depleted '-) )

Third chart should have buying on margin on the y axis, and 'Number of times saying "to the moon"' on the x axis ;)