The obstacles to scientific progress or: The Dead Parrot Sketch

The physicist Max Planck once quipped:

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Indeed, even in natural sciences like physics where experiments can confirm or reject a given scientific hypothesis it often takes the death of a leading scientist in a field before new ideas can take over and lead to progress in our understanding of the world. Albert Einstein was famously skeptical about quantum physics, the revolutionary theory developed by Max Planck and others. And while he eventually came to accept quantum physics as correct, he certainly wasn’t helping to spread it widely.

In social sciences like economics and finance the challenges for new scientific ideas are even greater because unlike in the natural sciences it is often impossible to create laboratory experiments that conclusively prove or disprove a given theory. As a result, even theories that have shown to fail in many instances in real life can survive for decades.

James Montier famously compared the Capital Asset Pricing Model (CAPM) – and by extension modern portfolio theory overall – with Monty Python’s Dead Parrot Sketch:

The CAPM is the financial theory equivalent of the ‘Monty Python Dead Parrot Sketch’. As many readers will know, an exceedingly annoyed customer who recently bought a parrot from a pet shop returns to the owner and berates:

‘He’s passed on. This parrot is no more! He has ceased to be! He’s expired and gone to meet his maker. He’s a stiff! Bereft of Life, he rests in peace! If you hadn’t nailed him to the perch he’d be pushing up daisies! His metabolic processes are now history! He’s off the twig! He’s kicked the bucket. He’s shuffled off his mortal coil, run down the curtain and joined the bleedin’ choir invisible! This is an ex-parrot!

Yet, despite the limitations and violations of modern portfolio theory discovered by behavioral economists, modern portfolio theory and the CAPM remain in wide use amongst both academics and practitioners. And there are still papers published today that try to show that some concepts of modern portfolio theory are superior to other approaches that have been shown to produce much better results for investors in the real world.

In fact, there are so many “zombie ideas” being used in economics and finance today that John Quiggin was able to write an entire book about them. Just think of trickle-down economics and the Laffer Curve, which are the foundations for the 2018 income tax cuts in the US. The idea there was that these income tax cuts should boost the economy so much, that the government would not suffer declining tax revenues and rising budget deficits. How is that working out?

I am not saying that these theories and zombie ideas are worthless. Modern portfolio theory and the CAPM have their value as academic concepts, and as such they deserve the many prices that the inventors of these theories have won. But investors shouldn’t apply these theories in real life and expect to get the best possible outcome for their investments. As behavioral finance and the emerging science of complex dynamic systems show, financial markets are far more complex than these old theories assume and as a result, these theories don’t work well in practice.

Yet, many of these theories are still not implemented by practitioners, asset managers and banks. The reasons range from considerations of career risk to monetary incentives. After all, it is hard to go to your customers and tell them that the way you invested their money over the last several decades has been suboptimal and they probably had much lower returns in the past than they could have.

What is needed to mainstream these new ideas is typically a generational change. In academia this often means that a star scientist in a field has to die, while in business it means that challenger companies (e.g. Vanguard) have to become so successful and big that they become an existential threat to an existing business model.

Pierre Azoulay and his colleagues have recently examined how new ideas spread in life sciences. They found that as long as a scientific field is dominated by a star scientist and his colleagues, there is little chance for new ideas in the field to gain acceptance. New ideas in a field are not consciously suppressed by star scientists and their collaborators but unconsciously because new ideas require research funding and this funding has to go through a peer review process. As a result, star scientists and their collaborators are able to control the use of resources and have an unconscious bias to recommend research projects that are in line with their theory and academic thinking.

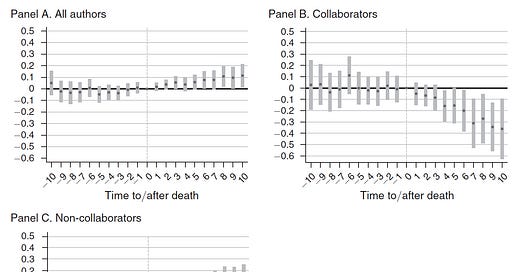

Once a star scientist in a field dies, the field is more open to outsiders who bring new ideas and concepts to a field. As a result, the academic output and importance of the old guard declines while new ideas become more prominent (see chart). In this sense, science progresses truly one funeral at a time.

Unfortunately, the study of Azoulay was done in life sciences where laboratory experiments provide hard data. In economics and finance, there are, as I said, moneyed interests at play that prevent finance from adopting new ideas. The result is that old ideas that have limited application in real life will continue to be used way past their use-by date. The losers in this game are the investor who are stuck with suboptimal portfolios and low returns.

Change in publication and funding flow in a subfield before and after a star scientist dies

Source: Azoulay et al. (2019).