The main challenge for the adoption of ESG investing remains the low quality of data available and the hodgepodge of criteria and dimensions investors try to cover under the banner of ESG. Yet, despite these challenges, more and more investors seem to be willing to give systematic ESG investing a try.

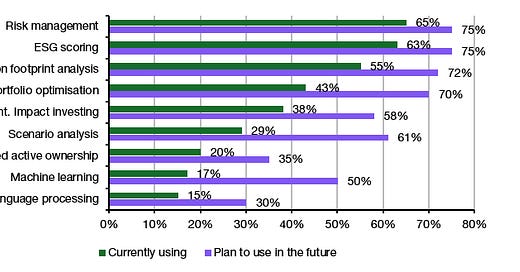

Invesco’s Global Systematic Investing Study 2023 is an interesting read for anyone involved in quantitative methods in investing. One area where I was surprised to see a large adoption rate of systematic approaches was in ESG investing. According to this survey of 130 institutional investors, 63% already use some form of a systematic approach to ESG investing. As the chart below shows, the most common use of systematic approaches in ESG investing is for risk management and quantitative ESG scoring, aka ESG ratings.

Use of systematic tools in ESG investing

Source: Invesco (2023)

As I have said many times before, I don’t think that ESG ratings work. And I make no exception for company internal ESG ratings. You simply cannot take dozens of different, mostly qualitative risk factors and force them into a simple one-dimensional scoring system. That is like saying that you can explain the return of assets using one linear factor. Who would be crazy enough to invest their money based on such an oversimplified model? But then again…

Item, as a friend of mine likes to say, one other thing caught my eye. The survey published some results by region and while there is largely agreement in the usefulness of a quantitative approach to ESG investing for risk management purposes or to enhance portfolio diversification, there is a significant regional difference when it comes to using quantitative approaches to ESG for return enhancement.

While investors in North America and Asia Pacific use quantitative ESG tools predominantly to enhance returns and only then to manage risks, investors in Europe use these tools primarily to manage risks. Return enhancement is quite low on the list of use cases for European investors. This is also visible in the use of quantitative ESG tools to manage portfolio biases and tilts, which are significantly more common in Europe than in other regions. It seems I am not alone in my view that ESG investing is mostly an exercise in risk management. Rather, it is a common refrain here in Europe, while investors in North America and Asia still hunt for returns with ESG tools. And let me tell you, the experience in Europe shows that this is going to be a futile effort.

Use of quantitative ESG tools

Source: Invesco (2023)

Totally agree on the points about low data quality and noisy ESG data. In my short experience writing about this very topic, I have not found evidence of ESG return enhancement as there is no free lunch.

Rather, the more thoughtful investors seem to use quantification as a tool to measure the price to pay (in terms of alpha) to reach their sustainable targets. Still a lot to learn in this field so thank you for shedding light on this!

A fair analysis, as others have said before - ESG investing is largely “Greenwashing”.

I have tried to find true ESG funds - those that have long term holdings in companies which will make a difference. A search on ‘climate change’ in Sharepad revealed 7 UK funds, none of which meets my test. The only one I could find is GMO Climate Change Investment, which offers a GBP£ class but is not available in the UK.

Does the knowledgeable Mr K know of any?