This post is part of a series on The Virtuous Investor. For an overview of the series and links to the other parts, click here.

“Moreover, consider how full of grief and misery, how short and transitory is this present life.”

Erasmus of Rotterdam

One of the central tenets of modern finance is that money is neutral. It is supposed to be a means to an end but in itself is neither good nor bad. A corollary sometimes derived from this tenet is that investing should not be concerned about ethics. It should simply be a trade-off between risk and return, where risk is narrowly defined as risk to the portfolio.

This central tenet of modern finance is wrong and so is the corollary derived from it.

Meir Statman, who is one of the leading experts on behavioural finance recently published a free book called Behavioral Finance: The Second Generation. In it, he describes how real people want more from their investments than simple returns. They also want expressive and emotional benefits from them. To quote from the introduction to his book (emphasis mine):

According to second-generation behavioral finance,

People are normal.

People construct portfolios as described by behavioral portfolio theory, where people’s portfolio wants extend beyond high expected returns and low risk, such as wants for social responsibility and social status.

People save and spend as described by behavioral life-cycle theory, where impediments, such as weak self-control, make it difficult to save and spend in the right way.

Expected returns of investments are accounted for by behavioral asset pricing theory, where differences in expected returns are determined by more than just differences in risk—for example, by levels of social responsibility and social status.

Markets are not efficient in the sense that price always equals value in them, but they are efficient in the sense that they are hard to beat.

You can think about ESG investing whatever you want, but you cannot argue with the fact that it satisfies an important want for many investors. More and more investors are concerned about climate change and environmental degradation. They are concerned about inequality and poverty and they are concerned about gender and racial inequality. And they want to do something about it.

The classic way to engage with these social and environmental issues is to engage in volunteering work and charitable giving. And if you are amongst the people wealthy enough to do so, you can even engage in fully structured philanthropy.

But how should you react if you are concerned about poverty and human rights abuses and then learn that one of your major holdings, e.g. Wal Mart or G4S, has been excluded by the Government Pension Fund of Norway for their human rights abuses? If you invest without ethical considerations and then use the money you earn with these investments to alleviate poverty and human rights abuses, have you really made a difference?

Modern finance does not account for cognitive dissonance. Modern finance assumes that we can compartmentalise our investments and our personal values and that one does not influence the other. But this is not true. The entire literature on cognitive dissonance shows that these internal contradictions make us feel terrible and we will do a lot to resolve this dissonance. In short, we want to be able to look ourselves in the mirror in the morning even if that means we are worse off financially.

Indeed, some people are willing to incur massive financial downside to stay true to their values. Of course, there are always going to be people who don’t care about the environment or social justice but in the 21st century, there seem to be fewer and fewer of them around. And luckily, in the 21st century, we don’t really have to compromise anymore on these things.

The reason why I write about ESG investing every Monday in my blog and about things like the virtuous investor every Wednesday is because it is my way of promoting the values that I find important. You may disagree with them and that is fine, but through my blog and my personal investments, I can express my values. Also, I can switch from traditional investment funds to funds with an ESG overlay. I can invest money in impact investments that not only create a financial return for me but also actively improve the situation in poor countries. And I can hire people with a diverse background to work for me (at least, once I am in the position of hiring people to work for me again).

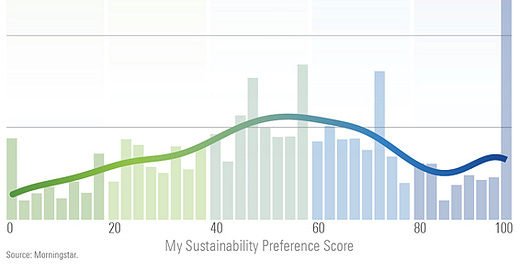

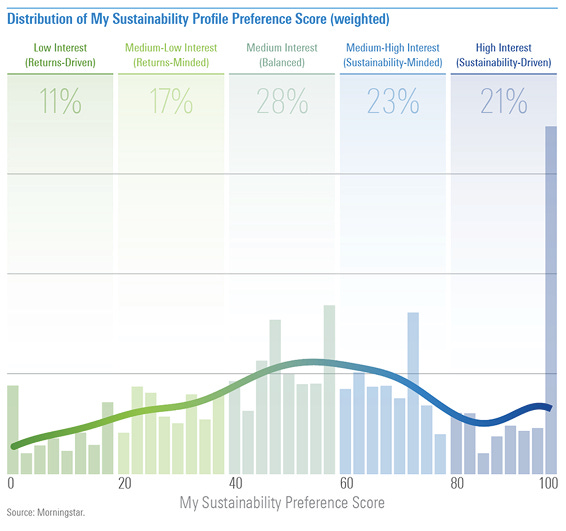

And so can you and your clients. As an investor, your choice is to invest traditionally and use the money to express your values or to simultaneously express your values with your investments and the returns you get from them. And if the returns are a little bit lower than with a traditional investment, my guess is that many will still be willing to invest in line with their values. In fact, it is not a guess. Morningstar tested a representative sample of US retail investors on their investment preferences by giving them the choice to split their investments between two stocks, one of which had a higher sustainability score than the other. They checked for different combinations of risk, return and sustainability and categorised investors based on the weight they gave to sustainability criteria relative to traditional risk and return considerations. The chart below shows that 44% (almost half) of respondents gave a weight of at least 60% to sustainability criteria and 72% gave a weight of at least 40% to these criteria. The share of investors who did not care about expressive values like sustainability was about one in four or less.

Importance of sustainability criteria for US investors

Source: Morningstar.

Cynics may say that once markets experience a downturn, these preferences will change again and investors will abandon ESG investments, but there are studies that show that investors stick with sustainable investments for longer than with traditional investments and hence may generate higher returns in the long run, as I have explained here.

What this means is that life is short, and we should all make sure we make it count for something. This can be charitable work, advocacy, and education (as I do with this blog and the books I write), but increasingly it can also be expressed with our investments.

And this creates a win-win because it will make us feel better (I must know; I get so much satisfaction and happiness from the responses of my readers and the discussions I have with them) but it will hopefully make the world a better place as well.