I am starting to become a fan of Henrik Bessembinder at Arizona State University. He has a knack for interesting research that is highly relevant for investors. Now he has looked at the performance of stocks in the United States since 1950 in a peculiar way. In a series of papers, he investigates the characteristics of extreme stock market performers over a time horizon of 10 years. He isn’t interested in market averages, but more in what makes a stock a superstar stock that ends up in the best 200 stocks of a decade – or what makes them absolute losers that end up in the worst 200 stocks of a decade.

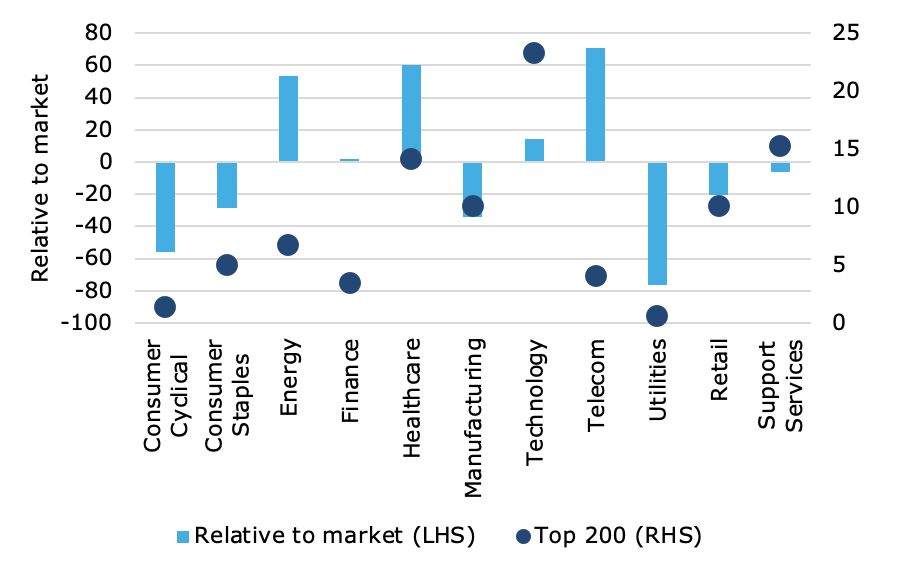

The second part of his series looks at the composition of these top 200 and bottom 200 stocks by sector. Given the success of companies like Apple, Amazon, Microsoft, etc. one is tempted to assume that technology stocks are the ones that have the highest returns. Well, it turns out that tech stocks are indeed overrepresented in the group of best-performing stocks. 23% of these super-stocks can be found in the tech sector, more than in any other sector. However, relative to the overall market, tech stocks aren’t the only place to make lots of money. The healthcare, telecom, and energy sectors are all vastly overrepresented in the top 200 stocks of each decade. These are the sectors where most wealth is created for investors and it pays to look in these sectors for great stocks to own.

Sector composition of top 200 stocks in each decade since 1950

Source: Bessembinder (2020).

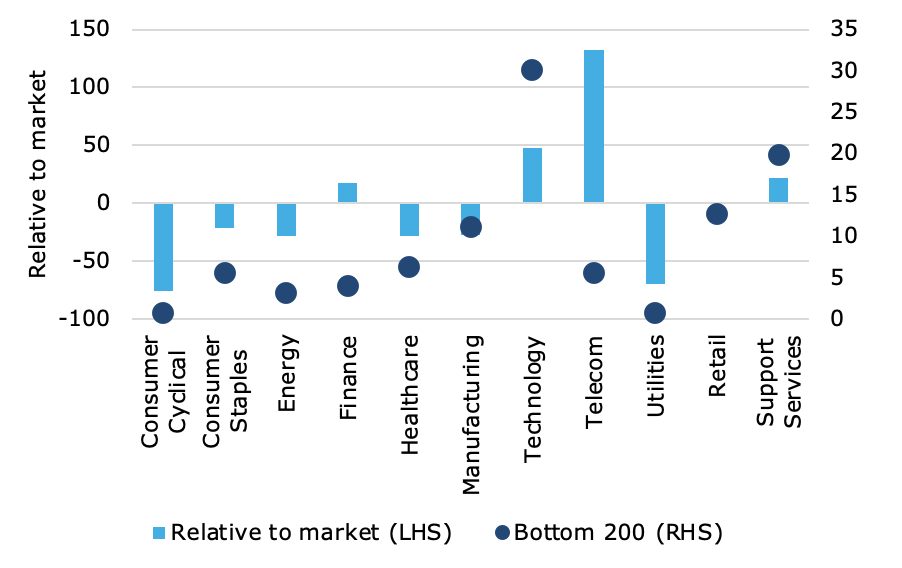

But there is also the flip side. When we look at the worst 200 stocks in each decade, tech stocks also form a large group of these stocks. Tech stocks make up 30% of the bottom 200 stocks in each decade, a bigger share than in the top 200. In other words, with tech stocks (and by the way also with telecom stocks) it is either top or flop and not much in the middle. And this means that if you invest in tech stocks, it is a place where fundamental analysis can pay off more than in other sectors because in no other sector is it as important to differentiate between winners and losers.

Sector composition of bottom 200 stocks in each decade since 1950

Source: Bessembinder (2020).

What a treasure. Thank you. I bought your book and loved it.

Thanks for sharing. Do you have a view on how much of this is trying to see the road ahead by looking at the rearview mirror? As in have you concluded Tech will remain the sector where doing fundamental analysis has the biggest bang for the buck?