In January, the newly appointed Chairman of Credit Suisse Antonio Horta-Osorio had to resign over breaches of Covid lockdown rules while visiting back in the UK. There are many reasons why he had to leave the troubled Swiss bank but one that has been discussed in the Swiss press to some extent is the culture clash between him and the Swiss people on the board and in the management. And while Horta-Osorio is Portuguese he is famously competitive and a manager very much in the mould of the Anglo-Saxon tradition coming from Lloyds, which he turned around after the financial crisis. And having lived in Switzerland for 21 years I can tell you that rubs Swiss people very much the wrong way.

That there is a cultural gap that leads to a differential treatment of Swiss people vs. Anglo-Saxons is indicated by the fact that Credit Suisse CEO Thomas Gottstein and former Chair Urs Rohner, both Swiss, could stay in their office despite overseeing the disastrous exposure to Greensill which cost the bank $3bn and the exposure to Archegos Capital, which cost $5.5bn. Compared to that, Horta-Osorio’s failing of attending the Wimbledon tennis tournament despite the requirement to self-isolate after arriving in the UK seems laughably inconsequential.

Indeed, research by Jinhua Wang from the University of Cambridge shows that a company that hires a manager that is a poor cultural fit has a problem in more ways than one. First, managers with a poor cultural fit have a shorter tenure at the company on average and get fired for comparatively minor reasons. Second, markets don’t appreciate it when a company hires a manager that is a poor cultural fit. Companies run by managers with a poor cultural fit significantly underperform companies run by managers with a good cultural fit, so much so that at least in theory one could create a long/short investment strategy out of that.

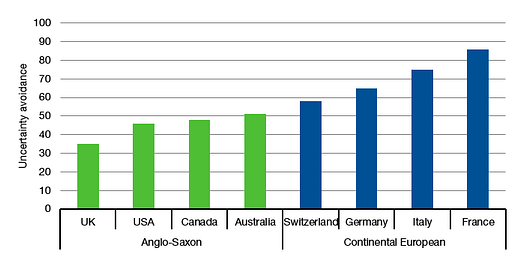

Meanwhile, Christophe Volonté from the University of Basel looked at Swiss companies run by Anglo-Saxon CEOs or chairmen. He found that Anglo-Saxon CEOs engage more in M&A activity and bigger takeovers than their Swiss peers. And as I have discussed here, that is not a good thing for the company. Similarly, corporate boards chaired by an Anglo-Saxon person tend to increase corporate leverage and decrease dividend payouts more than boards run by Swiss chairs. Both can be successful, but Swiss directors and CEOs tend to be more conservative than British or American ones and the culture clash leads to conflict within the firm that eventually puts pressure on the share price. Volonté argues that a key driver for the differences in management style are cultural differences in uncertainty avoidance. In general, people in Anglo-Saxon countries are more risk loving and embrace uncertainty more than people in continental European cultures. And that embrace of uncertainty leads to all kinds of differences in business behaviour. Why do you think there is a strong startup culture in the United States or the UK, but not in Switzerland or Germany? Starting a new business and commercialising a good idea is a project fraught with uncertainty and a high likelihood of failure. Not something that Swiss people tend to enjoy engaging in to begin with.

Uncertainty avoidance in different countries

Source: Hofstede (2018)

I just came across this study (by way of Matt‘s Thoughts In Between) https://journals.sagepub.com/doi/pdf/10.1177/0956797620916782

I was surprised by the difference in regional variation between the USA (low) vs the EU, India and China

Thank you for reminding us of the late, great Geert Hofstede. My own observation is that cross-cultural thinking gets a lot of lip-service from management, and occasionally some courses and workshops get organised. Maybe it‘s just me, but I have yet to come across a company that integrates cross-cultural considerations in its hiring and promotion policies. Tools that managers can use for daily decisions are even rarer. The question is: why?