In February, I wrote a post on the intraday movements of markets and how one can infer market sentiment from the drift in markets in reaction to macro news. Of course, the same effect can be witnessed in reaction to good or bad earnings news in the drift of share prices. Partially, this is what fuels the post earnings announcement drift. But is this sentiment drift big enough to make money from it?

Obviously, a trading strategy that buys shares at the market open or right after an earnings result is published and then sells these shares at the market close is going to have extremely high transaction costs and is thus almost guaranteed to lose money. But on a separate note, Ron Bird and his colleagues investigated if one could expand the holding period to something like 60 trading days (c. three months) and still get decent outperformance. To do this, they used their own methodology to analyse the emotional state of the market.

Sidenote: I read their paper in the summer and thought about writing a post about it but then decided against it for two reasons. First, as far as I can tell the results are closely related to the research I already wrote about in February, and second, the note was pretty poorly written. Note to academics who want their research to make an impact beyond the ivory tower: Please write in an engaging style that clearly lays out why your results are different from what we already know, how they are different, and how this is useful in practice.

Using their methodology, they simulated a simple trading strategy where stocks are bought right after they announce earnings. If the earnings surprise is positive but market sentiment is in the bottom quartile, they buy the stock and hold it for 60 trading days or until sentiment has improved by one standard deviation, whatever comes first. If the earnings surprise is negative and market sentiment is in the top quartile, they short the stock and buy it back after 60 trading days or after market sentiment has deteriorated by one standard deviation, whatever comes first.

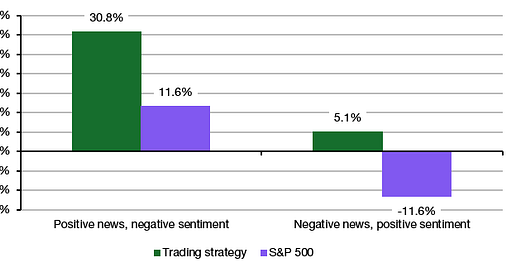

The idea behind this trading strategy is that it tries to exploit post earnings announcement drift as it is reinforced by sentiment shifts in markets. The chart below shows how this strategy works on the long and short leg in comparison to simply buying the S&P 500 and holding it as long as one would hold the stock in question.

Annual return of sentiment trading strategy vs. S&P 500 benchmark

Source: Bird et al. (2023)

Note how this approach seems to work exceptionally well on the long side. Buying stocks with a positive earnings surprise in a market depressed by negative sentiment is an excellent way to outperform. As market sentiment improves, investors wake up to the good news and push share prices higher. But it doesn’t seem to work that well on the short side. If market sentiment is optimistic, bad news simply is ignored and deteriorating sentiment is not enough to overcome the uplift from the days of positive market sentiment. In these circumstances, it seems negative earnings surprises simply get forgotten.

excellent. I have to see how this works out of sample.

I also like to look at the long-term (253 day) moving average of put/call options spreads. I think it would indicate whether basic market sentiment is rather high or low. Back in late 2021, positive sentiment was at a historical high, indicating too little fear and too much irrational exuberence, which I interpret as a clear warning sign. (That said, the market can remain exuberent longer than one can stay solvent.)