Apparently, ESG did work in the pandemic

I have been an outspoken sceptic of the claim that ESG funds proved their value in the pandemic. All the studies I have seen so far just look at the performance of ESG funds and ignore that most of these funds have a different sector composition than conventional funds.

However, now I have come across a study by Lubos Pastor and Blair Vorsatz from the University of Chicago that indicates that there is value to be found in the performance of ESG funds during the pandemic. The story just isn’t as simple as some people would like it.

What the researchers did was to sort ESG funds in the United States by Morningstar’s sustainability rating. 5 Globes for the funds that are considered the best sustainable investment funds down to 1 Globe for the funds that are full of unsustainable and brown investments. As I have argued here, these globe ratings should be taken with a grain of salt because many conventional funds are more sustainable than ESG funds, but I didn’t design the study…

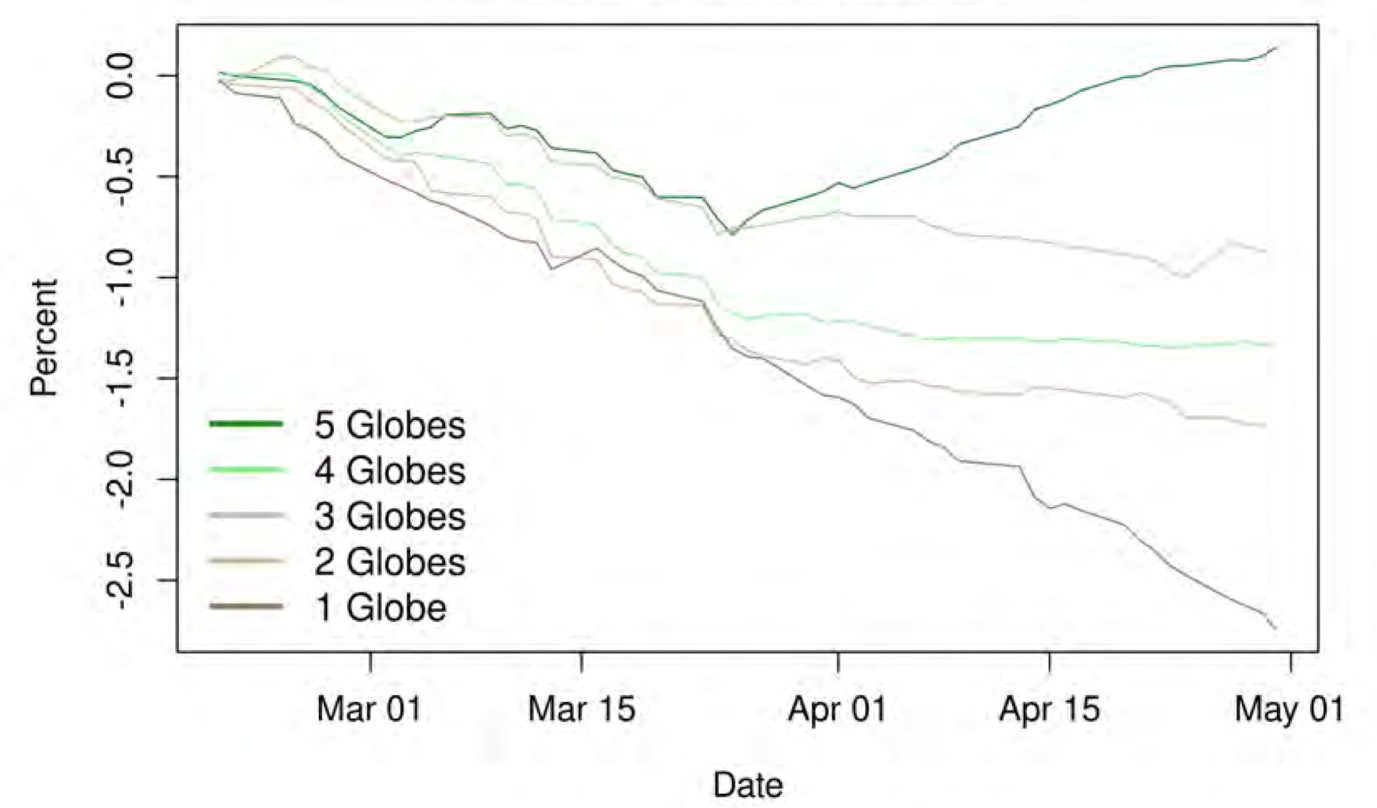

If you sort ESG funds by their sustainability rating, you find that most underperformed the benchmark they have chosen for themselves. Interestingly, the worse the sustainability rating, the bigger the underperformance. And 5 Globe ESG funds on average outperformed their benchmarks during the crisis.

Performance of ESG funds vs. their prospectus benchmark

Source: Pastor and Vorsatz (2020).

So high-quality ESG funds did indeed outperform during the crisis (but so did high-quality conventional funds). This stronger performance of high-quality ESG funds in turn attracted investor flows. ESG funds rated with 1 Globe face persistent outflows, while 5 Globe funds experience small inflows before the crisis, some outflows during the height of the panic, and then a rapid recovery in assets under management as markets recovered again.

ESG fund flows by stage of the crisis

Source: Pastor and Vorsatz (2020).

A more detailed picture shows that it is only the best and most sustainable funds that experience this rebound in flows. The vast majority of ESG funds experienced outflows even as stock markets recovered.

ESG fund flows by Morningstar sustainability rating

Source: Pastor and Vorsatz (2020).

In summary, if you are really serious about ESG investing and do a great job as a fund manager in selecting truly sustainable investments, you did perform really well during the crisis – and you are increasingly rewarded for it by investors. For all the other fund managers, the motto must be: do better next time and learn the lessons of this crisis.