Note: Please see the explainer to this series at the start of the first instalment.

I want to bring this little series of critiques of modern-day capitalism to a close (for now) by comparing today’s capitalist heroes with those of the Gilded Age in the US. The Gilded Age (roughly 1880 to 1900) was the classic period of excess in the US, when robber barons like John D. Rockefeller and Andrew Carnegie exploited workers to not only become as rich as kings but richer than them.

Sometimes, people claim that today’s wealth inequality is extreme and has never been seen before. But that is not true. Wealth inequality (and note, I am not talking about income inequality, which is what most people refer to when they discuss inequality) has been rising in the US and other developed countries for about five decades, but it is not (yet) as high as it was at the start of the 20th century. The chart below is taken from Gabriel Zucman’s website and shows the share of total assets owned by the richest 1% and 0.1% in the US.

Share of assets owned by richest Americans

Source: Gabriel Zucman webpage

The top 1% richest Americans owned an estimated 35% of all US assets in 2020 (the latest data available) compared to 46% in 1913. The top 0.1% owned 17.6% of all assets, compared to 24% in 1913. That is a lot, but still quite a bit less than at the start of the 20th century.

However, note that the difference between today and 1913 gets smaller when we go from the very rich top 1% to the super rich top 0.1% or, as they like to say in private banking, from the ‘haves’ to the ‘have yachts’.

However, let’s look at the share of total assets owned by the uber-rich top 0.01%, or as I like to call them the ‘have islands’. The chart below shows that these people are already as rich as the robber barons of the Gilded Age.

Share of assets owned by richest 0.01% of Americans

Source: Gabriel Zucman webpage

If you think I am unfairly singling out Americans, please be aware that I am doing this for a good reason. The chart below compares the share of assets owned by the richest 10% in a range of developed countries. American wealth inequality clearly is in a different category from other countries.

Wealth concentration among top 10% across OECD members

Source: OECD.

Americans like to point out that this kind of wealth creation is the result of Americans being better at capitalism, inventing better products and building better businesses than the rest of the world. Examples? Elon Musk built Tesla and SpaceX, Jeff Bezos built Amazon, Bill Gates built Microsoft, etc.

Without a doubt, these are enormously successful businesses that built great products. But that is, in my view, not the full story. You see, in a free and competitive market, successful businesses attract competition. As more and more competitors enter a market, profit margins of the established businesses decline and as a result, there is a limit to how large these companies can grow (even in a globalised world). But in the case of the most successful US companies that is not the case.

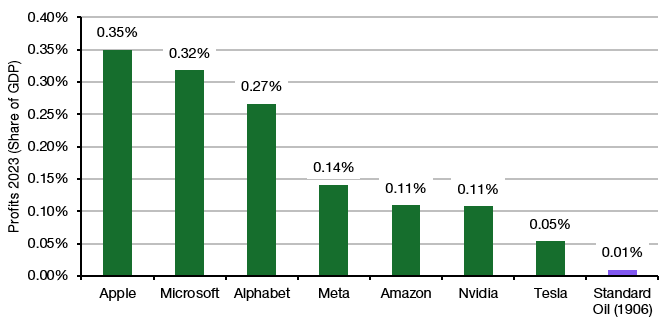

I recently published a note for my employer and thus behind a paywall where I analysed why the CAPE ratio has stopped working in the US while it keeps working in Europe. After weeks and weeks of analysis, the only reason I could find is summarised in the chart below. It shows the profits of the Magnificant 7 companies in the US compared to the US GDP. For comparison, I added John D. Rockefeller’s Standard Oil company in the year before it was broken up by antitrust enforcement.

Profits vs. US GDP for largest US companies

Source: Panmure Liberum, Bloomberg

Even the ‘least profitable’ of these companies is about five times as profitable as the monopolistic trust run by the biggest of all robber barons. Now, one may argue that Standard Oil was a US company while the Magnificent 7 are global companies, so comparing their profits to the US GDP is not fair. The US economy is c. 25% of global GDP, so a global company in a fully globalised world that has profits of more than 0.04% of US GDP is de facto larger than Standard Oil before it was broken up. Indeed, all these companies are larger than Standard Oil ever was, even when globalisation is taken into account.

I compared these results with European businesses and found nothing of the sort of profit concentration there.

The largest US businesses make monopolistic profits that in the past were unachievable because in competitive markets, profit margins are eroded over time. But in the US, many markets are no longer competitive. As I have explained before, US megacap tech companies are creating a kill zone to protect their markets and they can do so ever more effectively, the more money they make.

And this lack of competition is bad for other businesses and consumers alike because it allows these companies to crapify their products.

I have given up hope that the US government (or European governments, for that matter) will ever get serious about enforcing antitrust laws. It is always going to end up with a slap on the wrist because otherwise, ‘too many jobs are at risk’.

But one thing that I do not digest well is the difference in character between the robber barons of old and the current crop of billionaires. You see, one lesson history teaches us is that if inequality rises because a minority of ‘entrepreneurs’ exploits poor people, it ends at some point with the poor rioting in the street.

Rockefeller and Co. were no pushovers when it came to protecting their business interests. John D. Rockefeller had strikes at one of his companies put down with lethal force. But Rockefeller and his fellow robber barons still understood that with great wealth comes great responsibility. Andrew Carnegie started modern day philanthropy and every one of his peers followed suit. There is a reason why there is a Carnegie Foundation, a Rockefeller Foundation, and a Ford Foundation around. Today’s billionaires come up with hare-brained schemes like effective altruism. Carnegies, they are not.

Memorably, John D. Rockefeller had his credo inscribed in the Rockefeller Library at Brown University:

“I believe in the supreme worth of the individual and in his right to life, liberty and the pursuit of happiness.

I believe that every right implies a responsibility; every opportunity, an obligation; every possession, a duty.

I believe that the law was made for man and not man for the law; that government is the servant of the people and not their master.

I believe in the dignity of labor, whether with head or hand; that the world owes no man a living but that it owes every man an opportunity to make a living.

I believe that thrift is essential to well-ordered living and that economy is a prime requisite of a sound financial structure, whether in government, business or personal affairs.

I believe that truth and justice are fundamental to an enduring social order.

I believe in the sacredness of a promise, that a man's word should be as good as his bond, that character—not wealth or power or position—is of supreme worth.

I believe that the rendering of useful service is the common duty of mankind and that only in the purifying fire of sacrifice is the dross of selfishness consumed and the greatness of the human soul set free.

I believe in an all-wise and all-loving God, named by whatever name, and that the individual's highest fulfillment, greatest happiness and widest usefulness are to be found in living in harmony with His will.

I believe that love is the greatest thing in the world; that it alone can overcome hate; that right can and will triumph over might.”

With the exception of Bill Gates, which multi-billionaires would do, or even say, something like that today? Can you imagine Jeff Bezos setting up one of the largest philanthropic institutions in the world? His wife had to get divorced to follow in the footsteps of Rockefeller because Jeff Bezos was too busy sending d*** pics to his mistress and flying into space.

What about Elon Musk? Or Donald Trump? How do you think they would react if Rockefeller came back from the grave and told them that: “I believe in the sacredness of a promise, that a man's word should be as good as his bond, that character—not wealth or power or position—is of supreme worth”?

Capitalism in the past celebrated successful men for their business prowess but most people looked down on people with poor character no matter how rich they were.

Today, people are celebrated for being rich, no matter how shameless they conduct their business or how they got their wealth. Indeed, today, some people become rich by being infamous, rather than being skilled or creative.

This is a failure of today’s capitalism and – more importantly – a failure of today’s society. And, in my view, the world is a worse place for it.

Or to use Abraham Maslow’s words:

“If swindling pays, then it will not stop. The definition of the good society is one in which virtue pays. I can now add a slight variation to this; you cannot have a good society unless virtue pays.”

Thank you for this eye opening perspective. Wow.

Well put, Joachim. A society should be judged by how it treats its weakest members. It seems that we live in an age where the weakest are demonised and the richest are accorded the status of gods. But, as the Greeks - who knew a thing or two about gods and human nature - reminded us, gods are often capricious, jealous, vengeful, vain, self-serving and dishonest.