Over the last couple of weeks, I found myself debating with clients about the prospects for inflation. As long-time readers will know, I have been firmly in the camp of the folks who expected inflation to rise significantly about ten years ago. But as more and more empirical evidence came in on the ineffectiveness of quantitative easing and other monetary policies to spike inflation, I changed my mind and today, I think that inflation is unlikely to be a major problem in the next couple of years. But that wasn’t an easy process. It took me about two years to convert from one opinion to another and I still freely admit that I might well make a fool out of myself if inflation suddenly does rise dramatically and persists at high levels in the next couple of years.

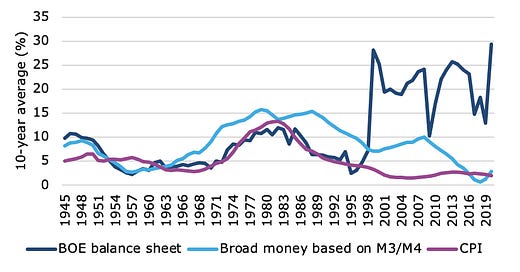

The core argument of investors and economists who are afraid inflation will rise dramatically in the next couple of years boils down to the old monetary theory of money printing causing inflation. I have dealt with that argument here and I show the important chart from that post below. In the past, printing money by the central bank did indeed lead to higher inflation. This was true for hundreds of years. But this relationship has broken down completely since the 1990s.

Monetary base and inflation since 1945

Source: Bank of England

And this is why I think economics and finance is so much fun. The monetarist theory of inflation was developed by Milton Friedman and others in the 1960s and proved to be an extremely successful theory to explain the high inflation period of the 1970s and informed the decisions of Fed chair Paul Volker in the early 1980s to fight inflation and usher in decades of declining inflation.

However, today, I tend to say about Milton Friedman that you only need to know two things about him. He is dead, and he was wrong. He wasn’t wrong in a historical context. As the chart above shows, when he developed his theories and for about another two decades afterwards, he was right.

Meanwhile, his neoclassical and neoliberal economist friends pushed for liberalisation and globalisation of trade and capital flows at the same time Friedman developed his monetary theory. Friedman was very much in favour of free trade and liberalisation, but ironically, globalisation and free capital flows are what would eventually change the economy to such a degree as to make his monetary theory invalid.

With the fall of socialism in Eastern Europe and the opening of China and other emerging markets money created by central banks could now be invested anywhere in the world where people could find the highest returns. Thus, a globalised economy reduces the link between local money creation and local inflation.

This is the beauty of what George Soros has called reflexivity. The economy doesn’t have immutable laws of nature. The economy is billions of people interacting with each other, each person changing his or her behaviour in response to the actions of other people.

In my book, I show how there is a difference between being a long-term investor and being stubborn. Knowing when a theory has stopped working is a crucial success factor for investors, and when I talk to people advocating monetarist theories today, I have to wonder if they are going to be right in the long run or if they are just stubborn and unable to change their opinions.

In any case, the lesson we need to learn is that in finance and economics no theory works forever. That is what makes investing fun. It is constantly changing, and it rewards those who can learn new things and adapt to this changing environment.

Great article, excellent insights. IMHO inflation is muted because all this monetary stimulus does NOT end up in the average person's bank account. It ends up in bank vaults, to be spent by a relatively few. To get inflation, govt workers will need more than the token 2% pay raises per year that they have been getting. Dityo for workers in private industry. the military, SS recipients, etc. Without $ in their individual bank accounts, the stimulus goes up in smoke--literally. Did you see the rocket launch with Bezos on it a couple of weeks ago? That is where the fiscal spending was burned up.

Thanks for the great articles. I appreciate how you're able to distill the data cocophany into the main themes.

There seems to be so much focus on inflation and a commodity supercycle at the moment. Do you think that the commodity supercycle talk is a result of so much focus on inflation concerns? If we don't see persistent inflation then does that mean that a big underpin of the commodity price frothiness disappears and there will be a pull-back to lower levels?

Thanks!