It would be unfair to say that you can always rely on economists from the Mercatus Center to try to resurrect dead economic theories. Reading their research is a little bit like reading the stuff from the Institute for Economic Affairs in the UK. You only believe that nonsense if you have stopped learning about economics in the 1980s and ignored all research of the last 40 years. Now, Scott Sumner, the inventor of market monetarism, and David Beckworth have published a barrage of papers arguing that central banks should adopt Nominal GDP Level Targeting (NGDPLT).

For the uninitiated, Nominal GDP Level Targeting is a form of monetarism that thinks that inflation targeting is a policy that is bound to fail and that the Federal Reserve and other central banks would be better off managing money supply in such a way as to hit nominal GPD targets in the medium-term. Note here that changes in nominal GDP come from the combined change of real GDP and inflation, so when real growth is low, inflation can be higher to stimulate future real growth and when real growth is high, inflation needs to be lowered to reduce nominal GDP growth.

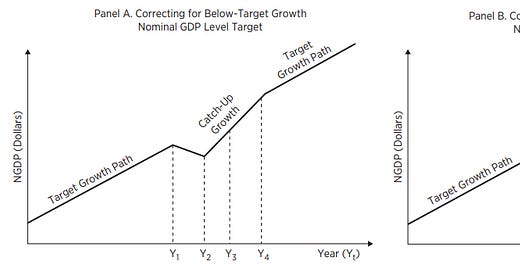

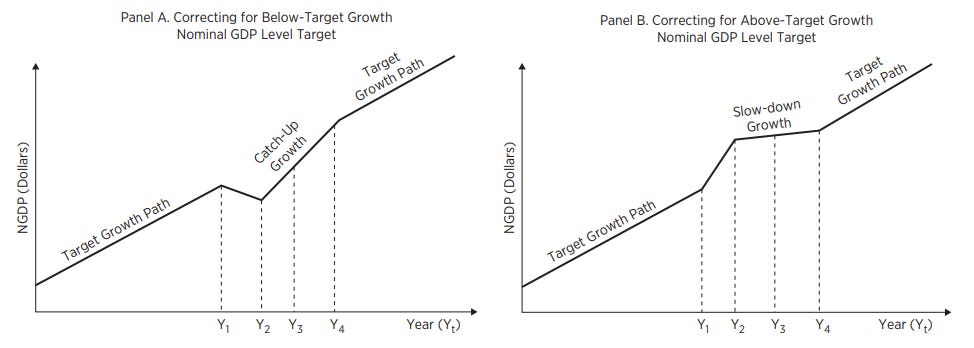

The benefit is that short-term fluctuations in inflation can be ignored and the central bank can try to focus on medium-term growth trajectories as shown in the two charts below taken from David Beckworth’s “Guide to a Popular Framework for Monetary Policy”.

How Nominal GDP Level Targeting works in theory

Source: Beckworth (2024).

I am not sure why Beckworth thinks that it is a ‘popular framework’ since NGDPLT is a fringe theory in macro circles but be that as it may. It essentially is a way of trying to resurrect monetarist theories of money supply growth.

I am not going to re-litigate my objections to monetarism and arguments about the velocity of money and all that stuff. Interested readers can read about how monetarism stopped working thirty years ago here, my arguments, why I think monetarism has broken down in the 1990s here, that really there is little relationship between money supply, inflation, and real interest rates here, that central banks have been unable to increase the velocity of money – a prerequisite to increase inflation in monetarist theories – for decades here, and that velocity of money is unlikely to reverse its secular decline in our modern debt-driven world here.

But I would like to point out a couple of cherries in Beckworth’s Guide to NGDPLT:

“If this [Nominal GDP Level] target were understood by the public and were credible, it would create expectations of stable money spending growth that would become self-fulfilling.” Yes, given how well the public understands inflation targeting I am confident, the man and woman on the street will be able to understand the complex interplay between inflation and real GDP growth that drives nominal GDP level targeting.

“This concept can be better understood by noting that changes in the supply of money are automatically offset by changes in the demand for money under NGDPLT.” Again, I hope the average man and woman on the street get the memo that they must demand less money whenever the central bank decides to cut the supply.

“NGDPLT is an effective way to deal with such ZLB [Zero Lower Bound when interest rates reach zero and can no longer be cut any further] experiences for two reasons. First, as noted earlier, NGDPLT makes up for past misses and allows for more inflation flexibility over the business cycle. Specifically, NGDPLT makes inflation countercyclical so that it would temporarily rise in a ZLB environment […] NGDPLT, in short, generates the temporary rise in inflation needed to escape a ZLB, something that is difficult to do with the Fed’s current inflation target.” Really? Why haven’t we thought of this before? I distinctly remember that all those monetarists claimed in the early 2010s that all that money printing by the Fed would lead to massive inflation. Now they are saying that all one must do when interest rates are zero is print more money to temporarily increase inflation. Remind me again, what is the definition of madness?

Finally, I wonder how NGDPLT is supposed to work in practice? In the 1960s to 1980s, the Fed manipulated interest rates to target growth in money supply. Today, it manipulates interest rates to target inflation. But the only tool it had back in the 1960s is still the only tool it has today. It can change the interest rate it pays to banks depositing money with the Fed. That’s it.

Unless, of course, we start taking that tool away from the Fed as well and replace it with a new way of monetary policy as Scott Sumner suggests. He thinks the Fed should introduce a nominal GDP futures market where investors can trade these futures. The Fed can then use the prices of these futures to understand what kind of nominal GDP growth markets expect at any given time. Then, the Fed takes this market signal and adjusts money supply until the futures market reflects the desired nominal GDP growth rate. The Fed would essentially trade against the hedge funds of this world and adjust its monetary policy based on what ‘the market’ tells the Fed what it wants to see. Speaking of the tail wagging the dog…

In social media the acronym ‘YOLO’ stands for “you only live once” and means one should do things that are exciting, even if they are silly or somewhat reckless. It looks to me like these monetarists and nominal GDP level targeters are a bit too reckless with the economy. I for one hope they will be kept as far away as possible from any real power.

I had a Summer job at the IEA once upon a time. Lots of free monographs…

This is a very thought-provoking piece – but I do wonder if one piece of the puzzle may have been missed in the analysis of your third final bullet point.

You imply that printing more money under NGDPLT at the zero-lower bound would have the same effect (ie, be ineffective) as doing the same under the current inflation-targeting framework – which of course, as you noted, took place in the early 2010s.

I’m not sure this is quite the whole picture. To reintroduce Paul Krugman to the conversation, in his 1998 paper “Japan’s Trap” he memorably wrote “The way to make monetary policy effective, then, is for the central bank to credibly promise to be irresponsible - to make a persuasive case that it will permit inflation to occur.”

I would posit that printing money at the ZLB in an attempt to hit a 2% inflation target is NOT the same as printing money at the ZLB in an attempt to push nominal GDP up by say, 10% or 15% to return to trend (as could be necessary in the case of a severe recession). Surely attempting to hit such a large number on nominal GDP growth (rather than being mandated to stop at the typical 2% inflation) could credibly be considered to be “irresponsible” by much of the public?

An assessment which would, of course, be exactly what is needed to make the policy work.