Every 12 to 18 months, the collapse of the US Dollar and the end of its hegemony in global trade is pronounced. Social media goes into overdrive debating how the Chinese Yuan is going to replace the Dollar, how China will sell its US Treasury holdings, sending the Dollar into a tailspin or how Democrats will turn the US into a socialist country impoverishing millions since nobody wants to hold the greenback anymore. Ok, I made the last one up, but you get my point.

The most recent episode of the ‘Dollar is going to collapse’ story has been triggered earlier this year by an agreement between Brazil and China early this year that allows imports and exports to be cleared not just in Dollars and Euros, but also in Yuan. And if you believe the Cassandras of this world, this will mean that all trade between Brazil and China will from now on be done in Yuan, just like apparently all trade between Russia and China as well as Iran and China already happen in Yuan, not in Dollars or Euro.

To start with, let’s remind ourselves that China has strict capital controls limiting both the inflow and outflow of Yuan. Hence, even if Brazilian exporters would accept Yuan, what are they going to do with it? They can’t use it domestically to pay their workers. They can’t convert it straight back into Real or other currencies because if they do, the volume of Yuan selling may hit capital restrictions and Chinese banks will simply be forced to refuse the cash. And they probably don’t want to invest the Yuan in China, because they have no business interest there in the first place. So, why bother accepting the Yuan in the first place?

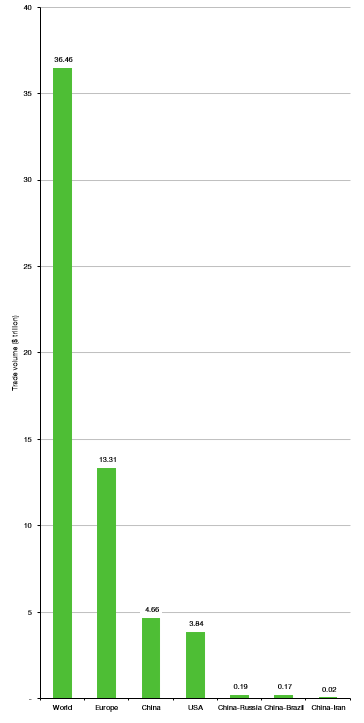

But let us assume for a moment that all Brazilian exports from now on will be denominated in Yuan. The chart below shows the total trade between China and Brazil in US Dollars together with the total trade in the US, Europe and worldwide. To show things from the right perspective, I have scaled the chart in such a way that the height of the bar for Brazil-China trade volume is 1mm (0.04 inches). I also add the total trade volume between China and Russia and Iran since similar trade agreements are in place there.

Trade volume around the world

Source: World Bank

I can already see US Treasury officials panicking about the status of the US Dollar in global trade…

Ok, but what about currency markets? After all, trading in Yuan is increasing rapidly and the share of FX trades that include the Yuan has almost doubled in the three years between 2019 and 2022. True, but incomplete. Because every FX trade requires two currencies, the current 7% market share of the Yuan in global FX markets just means that about 3.5% of all trades include the Yuan on one side of the trade or another. Meanwhile, the market share of the US Dollar is some 90%, unchanged for the last three decades. Over the last ten years, the trading volume in Yuan has grown by 15% p.a. At this rate (and I doubt this growth rate is sustainable in the long run, because of this reason) it would take until 2041 for trading volume in the Yuan to catch up with the US Dollar. If the growth rate averages a more reasonable 5% per year, it would take until 2075 for the Yuan trading volume to be about the same as the US Dollar. And even then, it doesn’t mean that the Dollar will collapse or be removed as the world’s reserve currency, as I have explained here.

Share of global currency markets

Source: BIS

Finally, there is the statement that China can tank both the Dollar and the Treasury market by simply selling their holdings of US Treasuries in the open market. I have called this the stupidest argument in economics but I increasingly think I have been too polite to the people who come up with this version of doom and gloom.

Currently, China holds $849bn in US Treasuries (as of April 2023) and is the second largest foreign holder of US Treasuries. But the Fed alone holds more than $5,000bn in US Treasuries and can buy the full $849bn China might sell in no time should financial markets get into trouble. But most likely, the Fed wouldn’t even have to intervene too much since markets would hardly move even if China dumped all its holdings into the secondary market.

Remember that since June 2022, the Treasury is running off its balance sheet and that at nearly twice the speed of its previous quantitative tightening. Between June and the end of April, the Fed sold c. $510bn in Treasuries into the open market. The result was a US Dollar and an S&P 500 that moved sideways. Between the start of 2023 and the end of April, the Fed sold $235bn of Treasuries and the result was an S&P 500 that was up 7.5% and a US Dollar that declined a massive 1.7%.

In short, the death of the Dollar is something that people like to forecast, but anyone who has a grasp of basic maths will soon find out that when it comes to global currency markets, the Yuan is an also ran, roughly as important as the Australian Dollar or the Canadian Dollar and China’s power over the US Dollar or the Treasury market is non-existent.

I am optimistic that the US Dollar will remain the global reserve currency and the dominant currency for trade and markets during my professional career and most likely during the rest of my life. If you believe the stories of the demise of the US Dollar, you will obviously try to sell all your greenbacks and move everything into gold or cryptocurrencies (which has worked like a charm over the last couple of years, as you know). You certainly can’t move it into the Yuan since that one has capital restrictions in place and is pegged to the Dollar (Hmmm, do I detect a circular argument here about the demise of the Dollar and the rise of the Yuan?).

Spot on, could not agree more. Well-written. Here's my two cents on the same topic: https://www.emorningcoffee.com/post/will-the-us-dollar-remain-the-global-reserve-currency

Sorry to be pedantic, but Cassandra’s prophecies were always accurate; it’s just that no one would listen to her, so the nation fell into ruin.